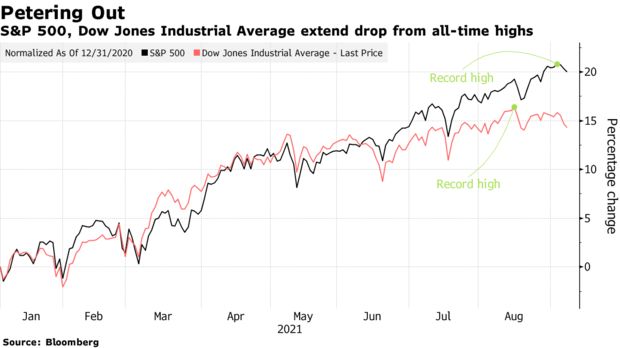

U.S. equities retreated as investors reassessed valuations in light of global economic risks including the spread of the Covid-19 delta variant and reductions in central bank stimulus.

The Nasdaq 100 notched its biggest drop in two weeks, with losses in megacaps including Apple Inc. and Facebook Inc. among the biggest contributors to the decline. The S&P 500 fell for a third day since it closed at a record on Sept. 2. The Dow Jones Industrial Average extended its retreat from last month’s all-time high to more than 1.5%. Europe’s Stoxx 600 dropped to a three-week low. Cryptocurrency-exposed stocks slumped as a selloff in Bitcoin continued.

Wednesday’s declines came as money managers from Morgan Stanley to Citigroup have turned cautious on U.S. equities. Many investors have begun to see relative U.S. valuations as excessive even as growth elsewhere suffers from renewed Covid lockdowns and travel curbs. They doubt the world is ready for an eventual tapering of central-bank stimulus even as inflation accelerates due to supply shocks. End-of-year seasonality and valuation concerns are adding to the gloomy mood.

“Momentum definitely seems to be slowing as far as the recovery is concerned,” Fiona Cincotta, a senior financial markets analyst at City Index, said by phone. “Before we’d been hearing that the Fed would tighten monetary policy and that’s what was unnerving the market. Now, it’s actually slightly softer data and also rising Covid cases.”

Morgan Stanley this week cut U.S. stocks to underweight and global equities to equal-weight, citing “outsized risks” to growth through October. Extremely bullish positioning means corrections can be amplified, Citigroup said. Credit Suisse Group AG said it has a small underweight on the U.S. market.

In Europe, growth concerns were compounded by speculation that the European Central Bank is getting ready to slow down emergency stimulus. EQT AB slumped in Stockholm after partners in the private equity firm sold a part of their holdings earlier than expected.

Meanwhile, the continued spread of Covid-19 is curbing economic activity around the world. The Philippines backtracked on easing curbs in the capital region, while Japan may extend state of emergency orders. Taiwan identified a delta variant outbreak in New Taipei City.

Equities climbed for an eighth day in Japan, supported by hopes for economic stimulus from the next prime minister. Pakistan’s stocks benchmark slid to the lowest since May after MSCI downgraded the country to a frontier market from an emerging market.